Key Points

- Only one top real estate brokerage is net profitable over 5 years

- Most profitable real estate brokerage reinvests in agent tools and support

- Traditional models face high expenses and shrinking margins

- Cloud-based brokerages offer better splits and lower agent fees

- Publicly traded brokerages provide transparency in financial performance

- Profitability affects commission splits and agent fees

- Real estate companies with caps protect agents from market downturns

- eXp Realty and Smart Agent Alliance support agent growth through collaboration

- eXp Realty had 75% profitable quarters—the best among top brokerages

Here’s the deal: if your brokerage is bleeding money, guess who’s footing the bill? Spoiler alert—it’s probably you. Whether it’s lower commission splits for you, random new “admin” fees, or a complete lack of decent tools, being at an unprofitable brokerage is like paying full price for a buffet that’s out of food.

On the flip side, the top real estate companies—the ones actually making money—are the ones investing back into their agents. Think of better tech, better support, and no “surprise” changes to your commission structure every time the market hiccups.

So if you’ve ever wondered what the most successful real estate company, or which of the top real estate brokerages in the US can actually survive the market chaos without dragging you down, this blog’s for you. Here’s your handy dandy index:

Table of Contents

Best Real Estate Brokerage Scope

Let’s zoom out for a second. We’re digging into 8 publicly traded real estate brokerage stocks—that’s roughly 15 well-known companies wrapped up into 3 different business models. Yeah, it’s a lot. But we’re not here to bore you with stock market fluff.

This isn’t about stock prices or Wall Street vibes. It’s about performance—real-world, boots-on-the-ground results. We’re looking at how these brokerages held up before COVID, during the absolute chaos of the 2021–2022 buying frenzy, and through the market slump that followed.

By focusing on the past five years of balance sheets, not crystal balls or analyst daydreams, we’ll show you which top real estate companies are actually built to last. Because at the end of the day, profitability isn’t just a flex—it directly impacts your wallet, your tools, and your future.

Real Estate Brokerage Profitability

Here’s why profitability matters: broke brokerages break agents. Period. If your brokerage isn’t turning a profit, it won’t take long before the pain trickles down to you.

Resources & Tools? Nope. When the money’s not there, neither are the upgrades. That shiny CRM or slick marketing platform? Yeah, you can forget about it.

Stability? Don’t count on it. Unprofitable brokerages are more likely to shut down, rebrand, or throw you into some clunky system mid-transaction while they scramble to stay afloat. Nothing says “confidence killer” like telling a client your brokerage just laid off half its staff.

Your Commission? At risk. A brokerage that’s bleeding cash only has a few plays: jack up agent fees, slash your split, or both. Why? Because agents are the revenue. If things go south, you’re the piggy bank.

Every top real estate brokerage company lives or dies by agent transactions. But how they manage expenses, leverage tech, and weather market shifts makes all the difference. The most profitable real estate brokerage isn’t just surviving—it’s setting its agents up to win.

If you want to compare brokerage commissions or fees, check out our traditional brokerage comparison charts.

So let’s break down who’s winning, who’s limping along, and who’s one bad quarter away from full-on panic mode.

Real Estate Brokerage Models

The real estate industry isn’t exactly known for staying ahead of the curve—but lately, brokerage models have been evolving faster than your clients ghost you after an open house. Let’s break down the four main types of real estate brokerage companies shaking up the scene:

Traditional brokerages are your classic franchise operations—brick-and-mortar offices, lots of middle managers, and a whole recruitment hierarchy that screams “corporate.” Think Coldwell Banker or Century 21. Reliable? Maybe. Efficient? Not so much.

Discount traditional brokerages are the same setup, just with thinner margins. Lower prices for clients mean thinner commissions for you. Yay?

Hybrid brokerages blend traditional setups with modern tech tools. You’ll still find offices and regional managers, but they’re at least trying to bring costs down with digital platforms and smarter systems. Compass is a good example here—trying to play both sides.

Cloud-based brokerages are the disruptors. No offices. No bloated staff. No middlemen taking a cut before you see your commission. These lean, tech-driven models—like eXp Realty, Fathom, and Real—use virtual tools and smart systems to cut expenses and boost agent value. When done right, they can offer high splits, low fees, and way more reinvestment into agent tools. For a deeper look at the advantages of modern models like eXp, check out what eXp agents get for their brokerage fees.

Bottom line? The most profitable real estate brokerage is usually the one that figured out how to stop lighting money on fire just to keep the lights on.

Brokerage Comparison Selection

Now, let’s talk about how we picked our players. We’re only looking at top real estate brokerages in the USA that are publicly traded. Why? Because if a company isn’t willing to show its financials, we’re not going to pretend it’s doing fine just because it slapped “#1” in its marketing.

Public companies offer transparency—actual numbers, real earnings, and no fairy dust. That makes this a solid apples-to-apples look at which brokerage models are thriving, and which ones are…well, doing their best.

We’ve got 8 brokerages or brokerage groups on the list, covering all four of the models above. Even if your company isn’t on the list, there’s a good chance one of these is its financial doppelgänger. So consider this your behind-the-scenes look at what might be happening in your corner of the real estate world. And, if you want an overview of top real estate firms that include some that are not publicly traded, see The Top Real Estate Companies in the U.S.

Here’s the lineup:

- Traditional: Anywhere (Sotheby’s, Coldwell Banker, Better Homes & Gardens, Century 21, Corcoran), Douglas Elliman, RE/MAX

- Traditional Discount: Redfin

- Hybrid: Compass

- Cloud-Based Modern: eXp Realty, Fathom, Real

Let’s see who’s actually making money—and who’s just burning investor cash with impressive branding.

Top Real Estate Companies

Let’s get to the good stuff—ranking the top real estate brokerages in the US based on one cold, hard metric: profitability. We’re using EPS (earnings per share) to measure this because EPS tells us exactly how much profit—or pain—a company is generating after all expenses are accounted for. No smoke, no mirrors.

We reviewed 20 quarters (that’s five years of receipts) and ranked each brokerage from worst to best based on how many of those quarters they actually made money. To keep it real, we also included each company’s cumulative net gain or loss over that time.

Quick heads up: a tiny brokerage might look better on paper simply because its losses are smaller in dollar terms. That’s why we’re focusing on the percentage of profitable quarters first and using total EPS net gain/loss as a secondary measure.

Basically, who’s making money most consistently—and who’s just hoping the next quarter is “the one.”

Number 8 – The Biggest Loser: Compass

Coming in dead last is Compass, our hybrid model darling that’s been all style, no substance. Over the past 20 quarters, Compass hasn’t posted a single profitable one. Zero. Zilch. A perfect 0-for-20 streak that even the worst sports teams would be ashamed of.

Its total net EPS loss? A staggering -13.18 per share—nearly twice as bad as the next-lowest performer. That’s not a little off-track—that’s “took the wrong train entirely.”

To be fair, the bleeding might be slowing. But if your business plan involves “losing less money over time,” you might want to revisit that pitch deck.

Here’s a chart of how that all played out:

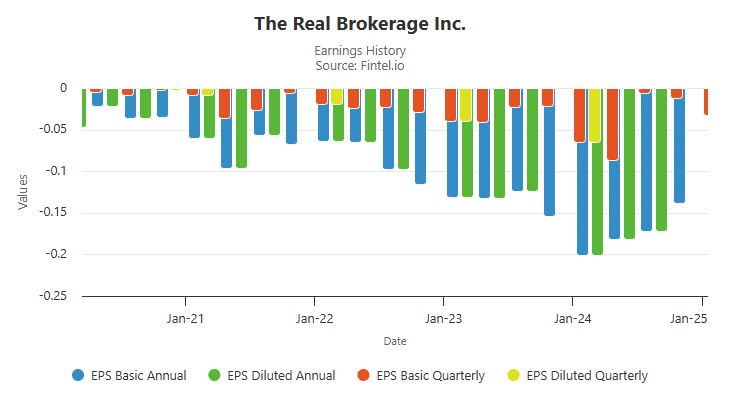

Number 7 – Real (But Not in a Good Way)

Next on the “please stop the bleeding” list is Real, one of the newer cloud-based brokerage models—and like Compass, they’re still batting a perfect 0-for-20 when it comes to profitability. That’s right, 100% unprofitable over five years.

Now, Real does have one thing going for it: it’s smaller. So the total damage is only -$0.56 per share, which looks way less scary than Compass’s jaw-dropper. But before you breathe a sigh of relief—don’t.

While Compass started off with massive losses that might be shrinking, Real did the opposite. Their losses started small and snowballed into a full-on disaster. And while things may be stabilizing a bit, the trend hasn’t exactly turned the corner.

So far, Real’s financial strategy looks like: “Let’s burn through capital, hope for hockey stick growth, and figure out profit… later?” Bold. But not great if you’re an agent looking for a stable home.

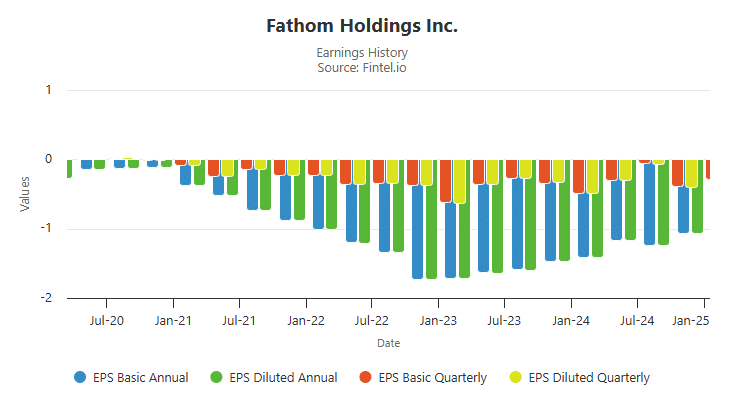

Number 6 – Fathom’s Deep Dive into the Red

Sliding into the number six spot is Fathom, another cloud-based modern brokerage that proves low overhead doesn’t automatically mean high profits. Out of 20 quarters, they’ve managed to turn a profit exactly once—which means they’re 95% unprofitable.

For a lean, tech-powered company, that’s… impressive in the worst way.

The one winning quarter? So small it’s basically a rounding error. Meanwhile, the losses? Huge. The chart might as well be a ski slope. With a total net EPS loss of -5.28 per share, Fathom’s financials are steep—and not in the “we’re growing fast” kind of way.

Even if the worst of the losses are behind them (and that’s a big “if”), the road to profitability looks long, bumpy, and uphill both ways.

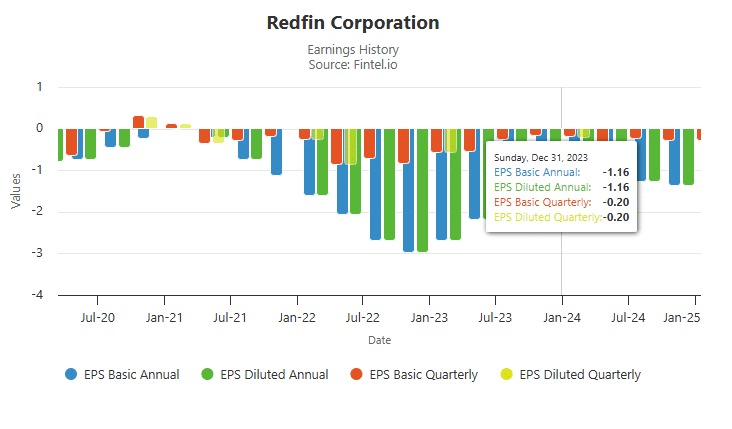

Number 5 – Redfin: Discount Brokerage, Premium Losses

Next up is Redfin, our token traditional discount brokerage—and let’s just say the discount extends to their profits too. Out of 20 quarters, Redfin has posted losses in 17 of them, which makes them 85% unprofitable.

Their total net EPS loss? A solid -6.94 per share. Not great for a company that was once hyped as a tech-forward disruptor set to revolutionize the industry.

Instead of shaking things up, Redfin’s been quietly shaking out cash. To be fair, their losses are trending lower, which is basically the financial equivalent of “it’s not as bad as it used to be.” But hey—when your business model is built around charging less, you’d better have the math dialed in. So far, it seems like they don’t.

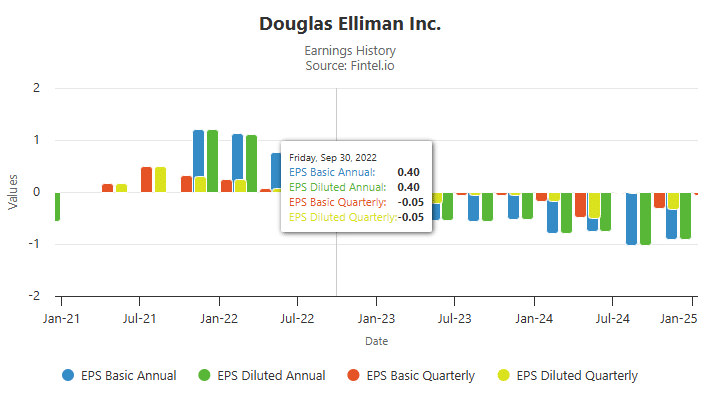

Number 4 – Douglas Elliman: Not the Worst, But Not Great

Coming in at number four is Douglas Elliman, with 16 quarters of data and 6 profitable quarters, making them 62.5% unprofitable overall. Not as brutal as some of the others, but still not exactly a victory lap.

Now, since it’s a smaller company, the total net loss is just -$0.31 per share over five years—basically a rounding error compared to the dumpster fires above. But don’t let the low dollar amount fool you.

The trend? Still sliding in the wrong direction. Losses might not be massive, but they’re consistent—like a slow leak you keep ignoring until the ceiling caves in. Douglas Elliman isn’t sinking fast, but they’re definitely not sailing smoothly either

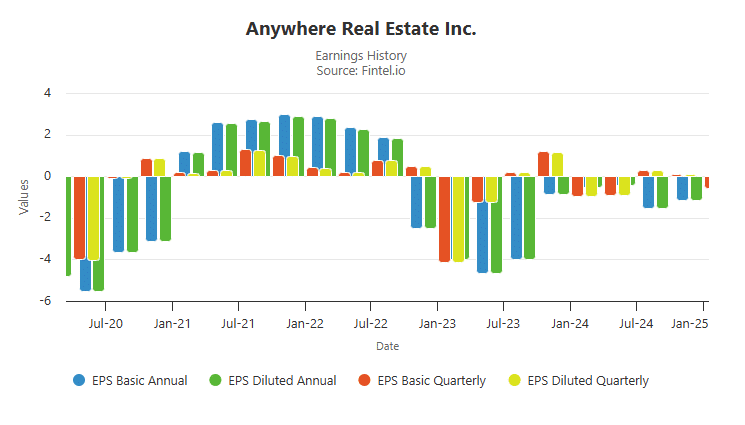

Number 3 – Anywhere: Big Names, Bigger Swings

At number three, we’ve got Anywhere—the giant traditional brokerage umbrella that covers Sotheby’s, Coldwell Banker, Better Homes & Gardens, Century 21, and Corcoran. With that many brand names under one roof, you’d hope some economies of scale would kick in—and to their credit, they kinda do.

Out of 20 quarters, Anywhere has managed 13 profitable quarters, giving them a 35% unprofitable rate and a 65% profitability rate. Not bad for a legacy model.

But here’s the rub: the bad quarters are really bad. Their total net EPS loss clocks in at -$4.94, which shows that when things go south, they don’t just stumble—they tumble.

So while they’re winning more than they’re losing, the scoreboard still shows red overall. Big reach, big names, big losses.

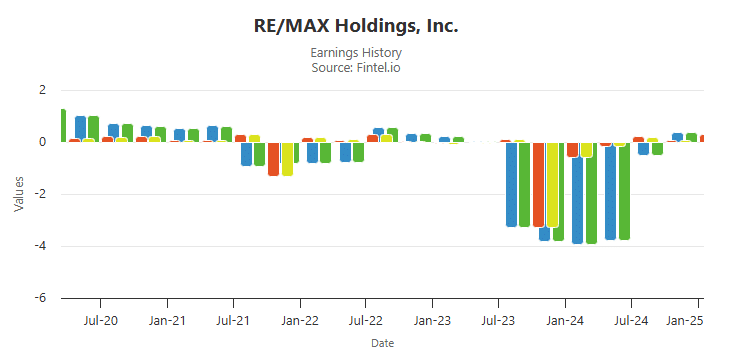

Number 2 – RE/MAX: Respectable, But Still in the Red

Snagging the runner-up spot is RE/MAX, one of the more familiar faces in the traditional brokerage world. With 13 profitable quarters out of 20, they match Anywhere’s 65% profitability rate—not too shabby for an old-school model.

But while they edge out Anywhere with a slightly better net EPS loss of -$3.43 per share, they still haven’t broken even over five years. And when RE/MAX has a bad quarter? It’s bad. The chart shows those downturns hit like a freight train.

So yes, they’ve been a solid performer in their category—but let’s not confuse “second-best” with “profitable.” They’re still losing money overall… just a little more gracefully.

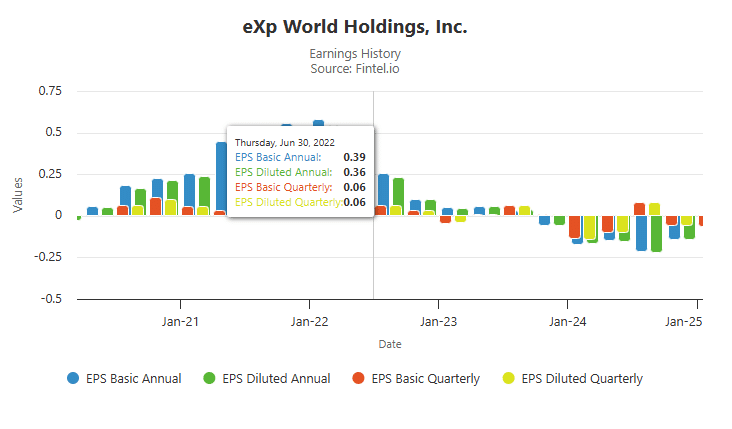

Number 1 – eXp Realty: The Only One in the Green

Taking the top spot by a mile is eXp Realty, the only brokerage on this list that can confidently say, “We made money.” Out of 20 quarters, 15 were profitable, giving eXp a 75% profitability rate.

But here’s the real mic-drop moment: eXp is the only publicly traded real estate brokerage to post a net gain over the past five years, with a cumulative EPS of +$.66 per share. That’s right—everyone else is bleeding red ink, and eXp is the one still standing in the black.

Even better, their profitable quarters didn’t just squeak by—they crushed it. The upswings far outweigh the losses, which shows they’re not just surviving; they’re scaling smart.

In a world where brokerages are slashing splits and hiking agent fees to stay afloat, eXp Realty is clearly built differently—and by different, we mean sustainable.

Future Outlook – Who’s Built to Weather the Storm?

So, what did we learn from all those charts and years of earnings data? These brokerages have been through it all—a so-so market, a red-hot frenzy, and the post-boom slump. That’s a rare, beautiful mess of data—and it tells us a lot about which models bend and which ones break.

A New Wave of Chaos

But now, every brokerage—profitable or not—is staring down a new challenge: the NAR settlement. With buyers and sellers more likely to DIY their transactions, and buyer agent commissions under a magnifying glass, we’re probably looking at fewer deals and tighter margins, especially for newer agents.

This matters a lot depending on how your brokerage earns its keep.

No cap? No cushion. Brokerages that rely on collecting a cut from every single transaction are about to feel the squeeze. Meanwhile, those with agent commission caps—like eXp Realty’s $16,000 yearly cap—have some insulation. Once an agent hits the cap, eXp doesn’t milk every future deal; just small admin fees. And yet, despite giving agents more, eXp still manages to be the only net profitable brokerage. Go figure.

Traditional Trouble Ahead

Traditional brokerages are looking at a much shakier future. Between franchise fees, physical offices, and layers of bloated staffing, their cost structure reads like a 2005 business plan. These expenses don’t do much for agents—but they sure eat up revenue.

Compare that to cloud-based brokerages: lower costs, higher splits for agents, and more financial runway to actually invest in useful tools. And yes, many still offer optional physical spaces when needed. The math just makes more sense.

Are We at the Blockbuster Moment?

We might be creeping toward a real turning point. As more agents jump to leaner, cloud-based brokerages, traditional models could struggle to cover their overhead. And when that happens, the usual moves kick in: higher agent fees, lower splits, and a mass agent exodus that’s hard to come back from. Check out anonymous agent reviews and you can see agent complaints are already in high gear.

It won’t happen overnight (remember Blockbuster?). But eventually, the industry catches on—and once it does, there’s no going back to late fees and laminated folders.

That said, not every cloud-based model is a guaranteed win either. As we’ve seen, even tech-forward brokerages can crash if their math doesn’t work. If the fees and splits don’t support profitability, they’ll face the same fate: rising costs for agents, less innovation, and fewer tools to help you win clients.

Bad math is still bad math. More agents just make it louder.

It Gets Better – What the Most Successful Real Estate Company + Smart Agent Alliance Offer You

The bottom line? Profitability matters—a lot. It’s not just a number on a balance sheet; it’s your brokerage’s ability to reinvest in tools, avoid surprise fee hikes, and stay standing when the market gets weird. That’s why Smart Agent Alliance partnered with eXp Realty—the only publicly traded brokerage that’s actually made money over the past five years.

At Smart Agent Alliance, we’re not just riding eXp’s momentum—we’re stacking extra value on top. When you join our team, you get access to exclusive tools and coaching designed to help you scale faster, work smarter, and keep more of what you earn:

- A done-for-you agent attraction website for both residential and commercial recruiting

- Social Agent Academy Pro—our advanced $10,500 social media marketing system

- Weekly mastermind coaching and strategy sessions led by top producers

- Step-by-step support for building your revenue share organization

- Ready-to-use lead generation funnels and automated email campaigns

- Customizable marketing templates to save time and boost engagement

These resources are provided at no extra cost to agents who join through Smart Agent Alliance. So if you’re looking to build a more profitable, stable, and scalable real estate business, it’s time to team up with a brokerage—and a team—that’s proven to invest in agents first.

To learn more about eXp Realty and Smart Agent Alliance, visit SmartAgentAlliance.com, explore our free tools, or book a meeting.

Frequently Asked Questions

What is the most profitable real estate brokerage?

eXp Realty is the most profitable publicly traded real estate brokerage, with 75% profitable quarters and a positive net EPS of $0.66 over the last five years.

Why does brokerage profitability matter to real estate agents?

Profitable brokerages can reinvest in tools, support, and training for agents. Unprofitable ones often raise agent fees or reduce commission splits to cover expenses.

What is the most successful real estate company for agents to join?

eXp Realty is considered the most successful due to its profitability, agent-first model, and high commission splits. It also offers strong revenue share and tech support.

Which brokerage model is the most sustainable for the future?

Cloud-based brokerage models are the most sustainable. They have lower overhead, offer higher agent payouts, and adapt better to market changes than traditional brokerages.

What benefits does Smart Agent Alliance provide to eXp agents?

Smart Agent Alliance offers free tools like a done-for-you recruiting website, lead funnels, the Social Agent Academy Pro system, weekly coaching calls, marketing templates, and revenue share training.

What are the top real estate companies by profitability?

eXp Realty ranks first, followed by RE/MAX and Anywhere. These companies had the most profitable quarters over five years among all publicly traded brokerages.

What is the most popular real estate company for agents?

eXp Realty has become one of the most popular real estate companies due to its cloud-based model, revenue share program, and agent support tools.

Which top real estate brokerages in the US are losing money?

Compass, Real, and Fathom Realty are the least profitable, with nearly all quarters showing losses and high cumulative EPS deficits over the past five years.

How do traditional brokerages compare to modern cloud-based models?

Traditional brokerages have higher expenses due to offices and franchise fees. Cloud-based models like eXp Realty offer lower fees, higher splits, and better profitability.

What is the highest paying real estate company for agents?

eXp Realty is one of the highest paying companies, offering high commission splits, a revenue share model, and agent equity programs without high overhead fees.

How does eXp Realty’s cap system protect agents?

Once agents pay a $16,000 cap to eXp Realty, they keep most of their commission. This helps agents earn more even in slow markets, unlike no-cap brokerages.

What makes Smart Agent Alliance different from other real estate teams?

Smart Agent Alliance gives agents access to exclusive marketing tools, lead systems, social media training, and weekly masterminds—all for free as part of the team.

Why are real estate agent fees rising at some brokerages?

Unprofitable brokerages often raise agent fees or lower splits to cover losses. Profitable brokerages are more likely to keep fees stable and reinvest in their agents.