Key Points

- 7-tier models generate 400% more agents vs 5-tier models.

- Revenue share can be passive and inherited.

- Most brokerages require recruits to unlock tiers.

- eXp has no production or fee requirements to earn rev share.

- Spreadsheet shows actual income comparison, not just marketing hype.

Let’s cut to it – if you’ve been researching real estate revenue share models, you’ve probably already been misled. Not by accident. Not because it’s complicated. But because a whole bunch of YouTubers are out here slinging “facts” that aged worse than expired milk.

Some of them mean well, but never updated their info after the last big brokerage shift. Others? They cherry-pick numbers to make their team look like a six-figure fairy tale, conveniently skipping over the fine print. And somehow, every revenue share video ends with a link to book a call… shocking.

So if you’re wondering “how does revenue share work?” or trying to figure out if eXp revenue share is better than Real’s, or if KW’s “profit share” is even in the same sport, good news, we actually ran the numbers. Real math. Not vibes.

This post strips out the sales fluff and makes every model easy to compare – apples to apples, not apples to ad copy. We’ll show you who pays what, how many tiers each model includes, which brokerages have sneaky rules buried in the footnotes, and how much you could actually earn, not just what someone promised in a webinar pitch.

Here’s your handy-dandy index:

Table of Contents

What Is Revenue Sharing? (And Why Agents Should Actually Care)

If the phrase “revenue share” sounds like one of those corporate buzzwords designed to make bad compensation sound better, buckle up. Revenue sharing in real estate is actually where things get interesting, especially if you’ve ever recommended your brokerage to another agent.

Here’s the revenue share definition: it’s a model where brokerages pay agents a cut of the company’s commission revenue when they refer new agents. Not profit-revenue. That’s before the expenses, marketing costs, or whatever your broker’s dog’s spa bill is this month.

And the upside? Massive. For example, eXp Realty revenue share paid agents over $200 million in 2024 alone. Some agents earn passive income topping seven figures a year. Even if you’re not planning to build a massive downline, ignoring what revenue sharing means is like ignoring compound interest. It’s a regret that shows up on every agent’s “wish I started sooner” list.

Why Revenue Share Income Is a Power Move for Agents

Let’s talk retirement plans – for people who don’t trust the stock market and don’t want to sell houses until their knees give out at an open house.

Revenue share income is one of the only paths in real estate that can keep paying you after you stop working. Most revenue share models allow income to continue into retirement (and even after death) as long as you meet a few basic requirements. Spoiler: You won’t find that perk in your commission check.

It’s not just money while you sleep. It’s income you can will to your family. And while brokerages all have slightly different rules (some easy to find, most buried like a secret menu item), the concept is the same – build it right, and this becomes your exit plan from real estate hustle culture.

How Brokerages Benefit from Revenue Share Models (Hint: They’re Not Altruists)

If you thought revenue-sharing companies created these models out of the kindness of their hearts… yeah, no.

Here’s how the game really works: brokerages like eXp, LPT, Real, and Fathom figured out they could outsource agent recruiting to, well, agents. No more bloated ad budgets or ineffective recruiters. Instead, you bring people in, and they toss a slice of their revenue your way. Everyone wins – if agents are producing.

More importantly, revenue share aligns incentives. Recruiters don’t earn unless their recruits are closing deals. So, ideally, they actually help new agents get started. That’s the pitch. Whether it plays out that way? Depends entirely on the people and the brokerage culture. At eXp, for instance, strong revenue share support teams like Smart Agent Alliance make it more than just lip service.

What You Should Actually Care About in a Revenue Share Model

Not all revenue share models are created equal – and no, your friend’s “I made $300 my first year!” testimonial doesn’t count as a reliable metric.

Here’s what you really need to look at:

Income Potential

Each revenue-sharing company has its own puzzle of payout tiers, unlock requirements, and an available revenue share income pool from which to pay recruiting agents. Some brokerages give you a slice of the pie across seven layers of your downline. Others cut you off at five.

Brokerage Sustainability: Because Your Downline Won’t Follow You Twice

Here’s the part most agents miss when chasing revenue share dreams: if your brokerage tanks, so does your passive income.

Building a downline isn’t easy – you invest time, training, and trust. But if your brokerage changes the rules, slaps on new fees, or just plain folds, you’re stuck. And no, most of your agents won’t follow you to the next big thing. They’re not switching to your next brokerage just to keep your income stream alive.

That’s why brokerage sustainability isn’t optional – it’s everything. You need a company that won’t buckle under market pressure or tweak its revenue share model every fiscal quarter.

eXp Realty is the only public brokerage with five years of cumulative profitability. Add the #1 anonymous agent rating, and you’ve got a stable platform to build real, long-term revenue share income, not a house of cards disguised as opportunity.

Pick wrong, and your exit plan turns into damage control. Pick right, and your downline keeps paying long after you stop selling.

Recruiting Differentiation: Why It’s Not a Level Playing Field

At LPT Realty, Fathom, and Real, every agent gets the same pitch deck. That’s not hyperbole – it’s literally the same recruiting offer across the board. Your “value proposition” is whatever the brokerage already provides. So, unless you’re promising 1-on-1 hand-holding or late-night therapy sessions, it’s hard to stand out from the next recruiter down the hall.

eXp Realty, on the other hand, lets agents get creative. You offer everything eXp brings to the table,e plus build your own revenue share value stack – custom training, tech tools, marketing systems, plug-and-play templates, full-blown agent attraction funnels.

Better yet, at eXp, sponsors can team up. You can collaborate inside your downline, creating value that no single agent could pull off solo. That’s how teams like Smart Agent Alliance thrive – by stacking tools, training, and community into one irresistible recruiting engine.

Bottom line? At eXp, you’re not locked into a cookie-cutter offer. You’re free to build something agents actually want to join and stay with.

The Big Names in Revenue Sharing: Who’s In This Breakdown?

Let’s break down the real contenders in the revenue-sharing arena – the brokerages that agents most often compare when deciding where to build a downline:

- eXp Realty – 7 tiers, 50% payout of company dollars, no fees, and no production requirement

- LPT Realty – 7 tiers, 50% payout, dual cap options, but delays rev share for 90 days

- Real Broker – 5 tiers, 60% payout of company dollar, but adds annual and percentage-based fees

- Fathom Realty – 5 tiers, 50% payout, lower caps, but has production requirements and fewer unlock paths

You’ll notice we’re not fully including Keller Williams here. Why? Because KW doesn’t offer revenue share. It offers profit share, and that’s a very different animal.

Profit share vs revenue share boils down to one key thing: timing. Revenue share pays before the brokerage takes out expenses. Profit share, like KW’s, only pays out after the bills are paid at the individual market center level.

And the difference in income potential is dramatic. Example: an agent at KW with 55 people in their downline was making about $700/month in profit share. When they moved that same downline to eXp Realty, they started earning $12,000/month. Same effort, wildly different results.

So, no offense to KW agents – but in this comparison, it’s just not a fair fight. For agents serious about building long-term, scalable revenue share income, the math knocks KW out of the ring before the first bell.

Comparing Revenue Sharing Tiers: 7 Tiers vs 5 Tiers = Big Money Gap

When it comes to revenue sharing, tier count matters – a lot. The more tiers a brokerage pays on, the more income you can earn as your downline grows.

Here’s how it stacks up:

- eXp Realty: 7 tiers

- LPT Realty: 7 tiers

- Real Broker: 5 tiers

- Fathom Realty: 5 tiers

That may not seem like a big deal – until you do the math. If you sponsor 2 agents and each person brings in 2 more, a 7-tier model grows to 254 agents. A 5-tier model? Just 62. That’s over 400% more agents in your downline for the exact same effort.

Now, imagine sponsoring 30 agents who each bring in 2 more. That’s 3,810 agents in a 7-tier model vs. 930 in a 5-tier model. Spoiler alert: No 5-tier brokerage can compete with those numbers in long-term revenue share income, regardless of how they spin it.

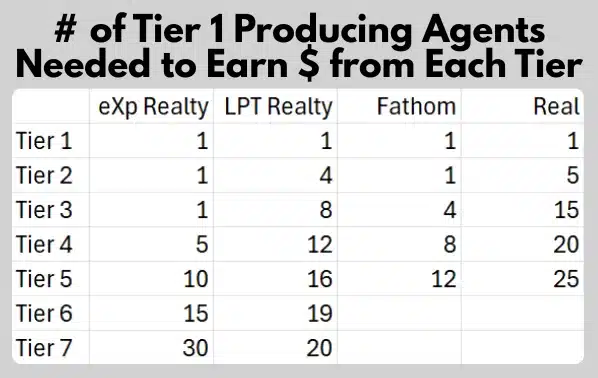

Comparing What It Takes to Unlock Tiers

Every revenue share model makes you work a little before you unlock all those juicy downline tiers. That’s by design – nobody’s handing out seven-level payouts to someone who added their cousin and called it a day.

Here’s the deal:

All four brokerages – eXp, LPT, Real, and Fathom – require you to sponsor a certain number of producing agents to unlock deeper tiers of revenue sharing. “Producing” means they’re closing deals, not just parked in your downline.

And yes, Fathom is a little different. It lets you count any agent, producing or not, toward unlocking those tiers. That sounds nice at first, but unless those agents are selling homes, your income isn’t going anywhere.

Now here’s what most people don’t tell you: unlocking tiers isn’t instant. Your Tier 1 agents (the ones you directly sponsor) take time to bring in their own recruits. And while they’re growing their downlines, you’re still growing yours – recruiting more Tier 1s and helping them succeed.

Your downline grows outward and downward at the same time. So as more agents join, produce, and build their own teams, your overall system starts to fill out, and more tiers open up naturally.

So don’t panic if you haven’t hit Tier 7 in six months. No one starts with a full pyramid and passive checks. But if you keep at it, those unlocks start triggering – and so does the income.

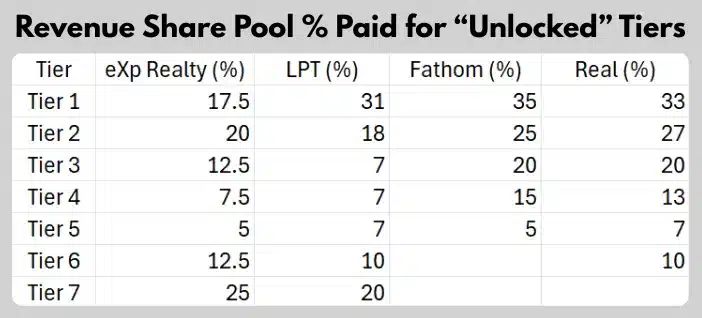

Comparing What Brokerages Pay at Each Tier

Alright, let’s talk about what you actually get paid in these revenue share models – because “up to” doesn’t pay the bills.

Each brokerage has a different setup, but the concept is the same: they take what they earn from their commission split with agents, called the cap, and carve out a chunk of that to fund the available revenue share pool. That’s the pool of money used to pay agents for attracting and supporting their downlines.

Now, how much of that pool each brokerage pays out – and how it’s divided among tiers – is where things start to vary.

- eXp Realty, LPT Realty, and Fathom Realty each commit to paying out 50% of the cap into the revenue share pool.

- Real Broker pays 60% of its cap, but it only spreads that across 5 tiers, not 7.

Let’s break that down with a real example:

At eXp Realty, agents have a $16,000 cap. Half of that – $8,000 – goes into the available revenue share pool per agent before they cap. That $8K is then split among up to 7 tiers of agents in your upline, depending on how many tiers you’ve unlocked.

And just to complicate things, each brokerage pays different percentages at each tier. Some throw most of the money at Tier 1, while others spread it more evenly, or save the big cuts for deeper levels.

To make things even messier, some brokerages advertise the maximum possible payout, others show minimum guaranteed, and a few blur the lines between a percentage of the agent’s commission and a percentage of the available pool.

We ignored the spin and built this analysis on consistent assumptions. No cherry-picked numbers. No “maybe if” projections. Just a clear, side-by-side breakdown of what each tier pays, based on each brokerage’s real cap, tier structure, and available revenue share pool.

Extra Revenue Share: What Happens When There’s Money… But No One to Pay

Here’s a twist: a brokerage’s available revenue share pool can have more money than the minimum the brokerage agreed to pay out. Not because they’re feeling generous, but because there’s no one eligible to receive it.

Let’s say an agent closes a deal. The brokerage earns its commission split – aka the cap – and sets aside half (or more) of that into the revenue share pool. That pool is supposed to be divided among eligible sponsors across the tiers. But what if:

- Some of those tiers haven’t been unlocked yet?

- Some agents in the upline are inactive or didn’t meet production requirements?

- The agent didn’t name a sponsor at all?

Now you’ve got real money with nowhere to go. What happens to that unassigned extra money depends entirely on the brokerage. eXp redistributes that extra revenue share each month to Levels 1, 2, and 3, giving newer recruiters a real income boost. It’s not small change either – many agents see 20–50% more in those early tier payouts thanks to this policy.

Important note: we didn’t factor this extra into any brokerage’s spreadsheet numbers, because it varies month to month. But if you’re comparing revenue sharing companies, ask them this: “What happens to unassigned revenue share funds?” Make sure they pass it through to recruiting agents.

Differences Too Uncertain to Calculate (But Too Important to Ignore)

Even with all the math and spreadsheets in the world, some parts of revenue sharing just can’t be cleanly calculated – because they depend on unpredictable agent behavior, hidden fine print, or fluctuating rules.

Here are the wild cards that could make or break your revenue share income, depending on the brokerage:

eXp’s Fast Start Bonus

Agents can earn up to $4,000 per recruit (instead of $1400 + extra) based on their 1st year with eXp production. It’s a serious boost, but since we can’t know how many new agents will hit the benchmark, we didn’t include it in our revenue share calculator.

LPT Realty’s 90-Day Delay

LPT doesn’t allow agents to earn revenue share income during their first 90 days. That’s a significant loss if you’re moving over a team or planning a fast start. So beware, this delay isn’t in our numbers, but it can undercut your early earnings.

Production Requirements

Some revenue-sharing companies tack on ongoing requirements.

- Fathom: You must close 1 deal every 6 months until you’ve got 12 recruits.

- Real: Requires agents to generate $450 in company dollars every 6 months to stay eligible.

- LPT: Requires $15,000 in production or revenue share earnings. Predictable so our calculations include it.

- eXp Realty: No production requirements or fees – earn from eXp revenue share whether you’re producing or not.

Real’s Revenue Share Fees

Real Broker charges $175/year plus 1.2% of all revenue share checks. These are predictable, so they’re factored into our model – but they still eat into your bottom line.

Fathom’s Unlock Advantage

Fathom lets you count non-producing agents to unlock tiers. That could speed up your revenue share model progression… but if those agents aren’t closing deals, your payout is still $0.

These factors vary so widely between agents and brokerages that they’re impossible to pin down universally. But just because some are hard to calculate doesn’t mean you should ignore them.

They’re the hidden costs and bonus opportunities that separate a great revenue share opportunity from one that quietly drains your potential.

Caution: LPT & Fathom Revenue Share Numbers May Be Inflated

Here’s a big flashing warning label before you fall in love with the spreadsheet numbers: LPT Realty and Fathom Realty offer more than one agent cap option, which makes their available revenue share pool a moving target.

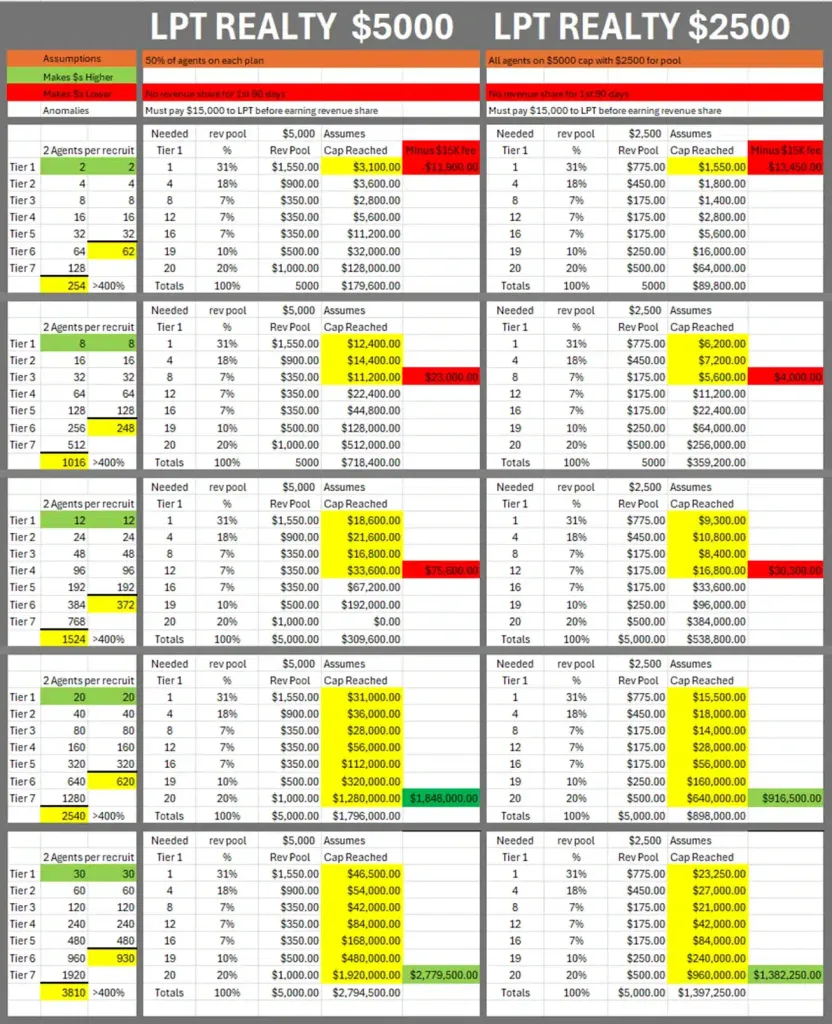

To compare these brokerages with the others, we had to make assumptions about the available revenue share pool. We made generous ones.

- LPT Realty agents can choose a $5,000 or $15,000 cap. Since 50% of that cap funds the revenue share model, it means some agents are contributing just $2,500 to the pool, others up to $7,500. We assumed a 50/50 agent split and used the midpoint: $5,000 in the pool per agent. In reality, it’s likely lower – LPT likely attracts mostly agents who choose the resulting $2500 pool.

- Fathom Realty also has two cap options: $9,000 or $12,000, leaving either $4,500 or $6,000 in the revenue share pool. Again, we used the midpoint ($5,250) to keep comparisons fair, but real-world earnings might be significantly lower depending on what plan most agents choose.

Long story short? The numbers for LPT and Fathom in our revenue share calculator are probably on the high side. We leaned toward optimism to give them the benefit of the doubt, but if anything, actual revenue share income from these brokerages may be much lower.

So if you’re comparing revenue sharing companies and see LPT or Fathom looking competitive on paper, remember: assumptions matter. And here, the assumptions lean in their favor.

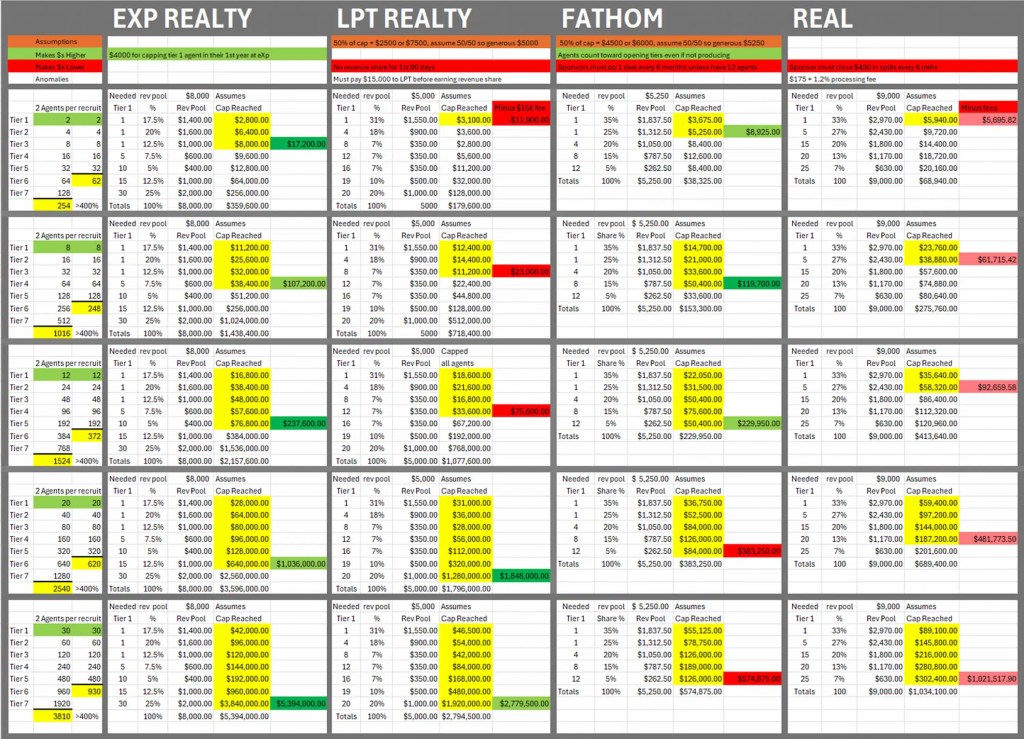

Potential Revenue Share Earnings Comparison: The Only Math That Matters

Okay, now that we’ve covered caps, tiers, unlocks, fine print, bonus policies, and fuzzy brokerage promises – let’s talk real earnings.

This is the part every agent thinks they understand… until they realize how many variables actually move the needle. It’s not just about what a brokerage pays per level or how many tiers it has. It’s about how all those pieces work together in the real world.

Our spreadsheet takes a conservative growth scenario:

- You sponsor the stated number of agents (your Tier 1).

- Those agents each sponsor an average of two more agents.

- Your downline fills in tier by tier over time, naturally expanding as both you and your recruits keep building.

From there, we calculated:

- How many agents land in each tier under each revenue share model (7-tier vs. 5-tier),

- How much each brokerage commits to the available revenue share pool, and

- The actual payout structure for every level.

- With Tier 1 agents of: 2,4,5,8,10,12,16,20,30 – opening difference tiers for at least 1 brokerage.

To keep it visual (and to satisfy our inner spreadsheet nerd), we color-coded the results:

- Dark Green = Best-earning brokerage for that agent count

- Red = Worst-earning brokerage for that agent count

- Light Green/Red = Second best/worst

- Yellow = Tiers that are unlocked based on how many producing Tier 1 agents you have.

Last, to avoid bias, we show Tier 1 agent numbers below that changed the ranking order (from best to worst) of at least 1 brokerage. That avoids us choosing Tier 1 agent numbers merely to make eXp look better than others.

We were obviously thrilled to see eXp Realty outperform the competition by a wide margin – no surprise there. But we were surprised when LPT Realty edged into first place in our initial look at 20 agents. As noted above, that result hinged on a generous assumption: we calculated earnings as if half of LPT’s agents were enrolled in their higher-tier revenue share plan.

Realistically, that’s a stretch. Most agents who switch to a 100% commission brokerage like LPT (especially with their lower agent support) are doing it to maximize take-home pay, not to opt into a split with better rev share potential. So, we decided to run the numbers again, this time assuming the worst-case scenario: every agent on the lower revenue share plan.

Below we show the original calculation ($5000 for revshare pool) and the worst possibility ($2500 for revshare). We changed the highlighted color on the right to reflect how LPT Realty would then stack up against the other three brokerages. Here’s how that changed the outcome.

Bottom line: with 20 agents, LPT moves from best to 2nd best. So, in the worst-case rev share pool scenario, LPT Realty never beats eXp Realty. Regarding the truth of LPT’s rev share pool, the truth probably falls somewhere in between these two sets of numbers. But, even then, eXp holds a strong advantage.

So, Who Actually Wins the Revenue Share Game?

Here’s the short version: not all revenue share models are worth your time. Some look good on a marketing slide but fall apart when you run the numbers – or worse, when you realize your check’s been trimmed down by mystery fees and locked tiers.

eXp Realty stands out not just because it pays well, but because it’s built to last. It offers:

- A full 7-tier revenue sharing model

- A massive available revenue share pool

- No production requirements or participation fees

- Bonus earnings from overflow payouts

- And the only publicly traded brokerage that’s been cumulatively profitable for the past 5 years

But let’s be real, revenue share isn’t just about the brokerage. It’s also about your sponsor.

Because if you’re serious about building this income stream, who you name as your sponsor matters just as much as the model itself.

Speaking of brokerages…

When you choose Smart Agent Alliance as your sponsor at eXp Realty, you don’t just get the most profitable brokerage with the highest anonymous agent reviews. You also get the firepower of two elite sponsor teams – Smart Agent Alliance + the Wolf Pack – joining forces to actually support your business.

We’re talking:

- A personal agent attraction page

- Automated follow-up and webinars

- A top-ranked team website

- 8 lead-gen landing pages with email automation

- 100’s of stunning plug-and-play marketing templates

- Quick-start production plans

- Access to everything eXp + SAA in one agent portal

- Weekly strategy calls, high-level coaching, and private community groups

- Social Agent Academy Pro ($10.5K value)

- Flipping, production, systems training, and more

And yes, it’s all free when you name a Smart Agent Alliance founder as your sponsor.

So you can roll the dice with a random recruiter and hope for the best…

Or plug into a sponsor team that already built the engine – all you have to do is drive.

Curious about passive income? Try our Revenue Share Calculator.

Want to know how much more commission you’ll keep? Try our eXp Commission Calculator.

Learn more about eXp Realty.

Frequently Asked Questions

What is revenue share in real estate?

Revenue share is when a brokerage pays agents a cut of its income for referring new agents.

How does revenue share work at eXp Realty?

eXp pays up to $8,000 per agent recruited, split over 7 tiers, with no production requirement.

What’s the difference between profit share and revenue share?

Profit share pays after brokerage expenses; revenue share pays before expenses are deducted.

Which real estate brokerage has the best revenue share?

eXp Realty ranks highest due to 7 tiers, no fees, and consistent agent payouts.

Is revenue share passive income for agents?

Yes, many brokerages let agents earn rev share after retirement or even after death.