For real estate agents choosing between Fathom Realty and Sotheby’s International Realty, the decision often comes down to one pivotal question: is luxury branding really worth the price tag? On one side, you have Fathom’s clean-cut, 100% commission model that lets agents keep every dollar they earn. It’s a magnet for independent, cost-conscious agents who prioritize net income over brand name. On the other side is Sotheby’s—a legacy luxury brand that brings instant credibility but charges dearly for the privilege, with commission splits, franchise fees, and other costs that can siphon away 30 to 40 percent of your commission.

But as the real estate industry evolves, more agents are questioning this binary choice. Why sacrifice profitability for branding or branding for autonomy when modern brokerages are starting to blend the best of both? In this breakdown, we’ll compare the structure, support, and agent experience at both Fathom and Sotheby’s, while exploring the growing appeal of newer brokerage models that don’t force you to choose between income and sophistication.

Commission Structures: A Tale of Two Philosophies

Fathom Realty offers a straightforward proposition. Agents choose between a Share Plan with an 88/12 split that caps at $12,000 before switching to 100%, or a Max Plan offering 100% from day one with a lower $9,000 cap. There are no franchise or royalty fees. Annual costs hover around $700, and per-transaction fees are either $165 under the Share Plan or $465 under the Max Plan, with additional charges only on higher-priced sales. For high-volume agents, the savings are hard to ignore. An agent producing $10 million in volume could save over $300,000 per year compared to traditional split-based models—enough to fund a premium ad budget, a full-time assistant, or a vacation home.

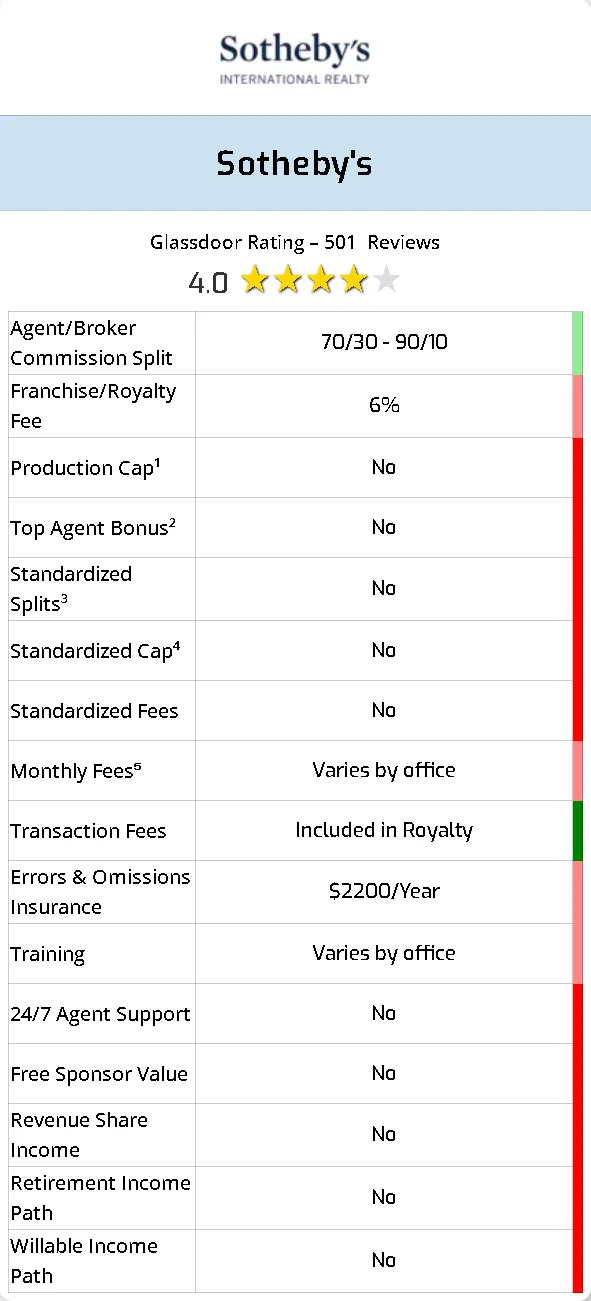

Sotheby’s takes the opposite approach, charging agents commission splits ranging from 70/30 to 90/10 along with a 6% franchise fee and additional costs that often lack transparency. Just their E&O insurance alone starts at $2,200 annually. While these expenses may be justified for agents consistently closing $5 million luxury properties, they often hit mid-tier agents the hardest. For example, an agent selling a $1.5 million listing at Sotheby’s with an 80/20 split might walk away with just $33,600 after fees. That same deal at Fathom could yield around $44,550—nearly $11,000 more per sale, lost simply to brand overhead.

Agents who once felt trapped between these extremes are now looking toward hybrid brokerages that offer generous commission caps alongside luxury-grade branding resources and collaborative communities. These models aim to provide the polish of Sotheby’s with the profitability of Fathom—without the financial drain.

Income Potential Beyond Commissions

Both Fathom and Sotheby’s reveal their limitations when it comes to long-term wealth building. At Fathom, your income stops the moment your closings do. There’s no revenue share, no stock equity, and no retirement plan. While it’s perfect for agents who want to earn and keep as much as possible right now, it leaves no room for passive income or business continuity.

Sotheby’s doesn’t do much better. Despite its global presence and massive referral network, the company doesn’t offer formal team-building incentives, equity options, or passive income systems. You’re leveraging the brand, but once again, the only way to earn is to close more sales. This absence of alternative income streams is a missed opportunity—especially for agents with deep client networks and long-term relationships that could be monetized beyond single transactions.

Meanwhile, forward-thinking brokerages are rolling out models that give agents access to multiple revenue paths. Some offer revenue share for team growth, stock rewards for production milestones, and even profit-sharing or retirement matching programs. These options allow agents to build businesses that scale beyond their own transaction count—something neither Fathom nor Sotheby’s has meaningfully addressed.

Training and Support Systems Compared

Fathom Realty’s approach to training is minimal at best. New agents receive no formal onboarding, and even experienced professionals entering the luxury market will find no structured guidance on how to navigate high-net-worth clientele or complex listings. It’s a model built on self-sufficiency, which works for seasoned agents—but leaves newer agents or those transitioning to luxury with a steep learning curve.

Sotheby’s does offer more robust training, but the experience depends entirely on the office you’re affiliated with. Some agents benefit from excellent coaching and mentorship, while others find themselves left with generic presentations and dated onboarding sessions. One consistent complaint across both brokerages is the lack of responsive, real-time support. For agents handling multi-million-dollar negotiations on tight timelines, the absence of 24/7 backup can be a dealbreaker.

Brokerages that are redefining support today typically combine on-demand training libraries with live daily coaching and full-time transaction assistance. These resources are essential in luxury real estate, where the stakes are high, clients are demanding, and every detail matters.

Technology and Marketing Resources

Fathom provides basic back-end tools like transaction management systems and limited marketing templates. But agents are largely expected to source and pay for their own CRM, lead generation platforms, and automation tools. That may work for tech-savvy agents who want to choose their own stack, but in luxury real estate, a bare-bones setup can put you at a disadvantage. High-end clients expect polished virtual tours, AI-driven property alerts, and seamless digital experiences—and at Fathom, those services aren’t built into the model.

Sotheby’s makes a bigger investment in marketing, especially when it comes to presentation. Glossy brochures, branded listing packages, and global syndication are all part of the draw. But many agents report that these tools are more about brand consistency than business efficiency. The backend systems often feel outdated and disconnected, lacking the automation and customization capabilities today’s agents expect.

The most effective brokerages now combine branding excellence with real business-building tools. They provide integrated CRMs designed for luxury clients, AI tools for nurturing high-net-worth leads, and automated marketing suites that deliver premium campaigns with minimal agent effort. These platforms save time, increase visibility, and elevate the experience for both agents and clients.

Agent Satisfaction and Cultural Fit

Glassdoor reviews provide an honest peek behind the curtain. Fathom Realty receives high marks for financial freedom, consistently scoring around 4.6 out of 5. Agents love the control and low fees, but many note that the experience can feel isolating. One agent summed it up by saying, “You’ll keep more money, but you’ll hit a ceiling unless you’re extremely self-motivated.”

Sotheby’s earns a solid 4.0 out of 5, with many agents citing the prestige and networking opportunities as key benefits. But a deeper look reveals growing frustration with outdated systems and fee structures that don’t match today’s expectations. As one veteran agent put it, “It’s a great brand, but the cost only makes sense if you’re closing high-end listings every month.”

Agents today are searching for a mix of transparency, affordability, brand strength, and collaborative energy. They want a culture that prioritizes both financial gain and professional development, not just one or the other.

The Verdict: Who Each Model Serves Best

Fathom Realty is a great fit for agents who already have their systems in place and want to keep as much of their income as possible. It’s ideal for high-volume producers working in mid-tier markets or experienced professionals who don’t need mentorship or marketing help. If you’re confident running your business solo, it’s a profitable model—but it comes with limitations.

Sotheby’s makes sense for agents in luxury-heavy markets who can truly leverage the brand. If you’re consistently listing $3 million and up properties and want to align with a heritage name that opens doors, the cost may be justified. But for agents selling homes in the $1–2 million range, the math can be tough to swallow, especially with no additional income options or true business scalability.

Still, both models leave something on the table.

Why Smart Agent Alliance Agents Thrive at eXp Realty

Our team at Smart Agent Alliance is built for agents who want to:

- Keep More Money: Retain up to 100% of commissions after cap, with no hidden fees.

- Build Beyond Themselves: Earn revenue share from your team and stock grants for hitting goals.

- Access Turnkey Systems: From done-for-you lead generation funnels to weekly masterminds with 7-figure agents.

- We don’t believe in “one-size-fits-all” real estate. That’s why we provide free, customizable tools to help you scale your way—whether you’re a solo agent or building a mega-team.