This article will provide a comprehensive comparison between Coldwell Banker vs Keller Williams to help you determine which brokerage better aligns with your professional goals. Choosing the right brokerage is a critical decision for any real estate agent, as it significantly impacts their career trajectory and financial success.

Commission Splits and Fees

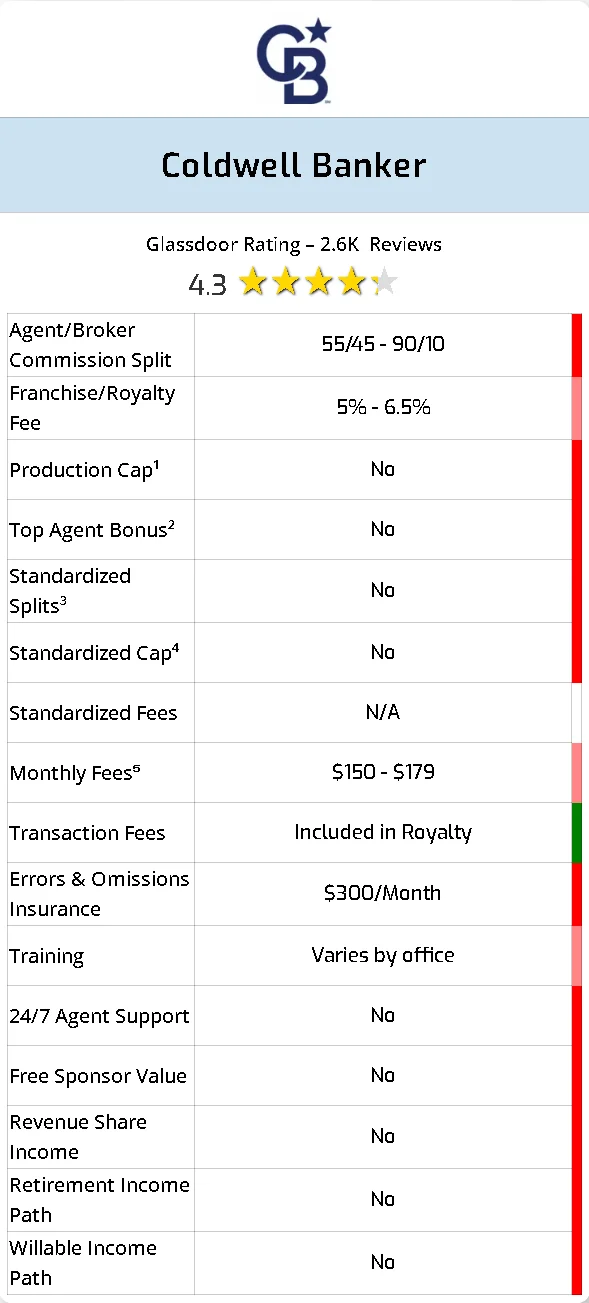

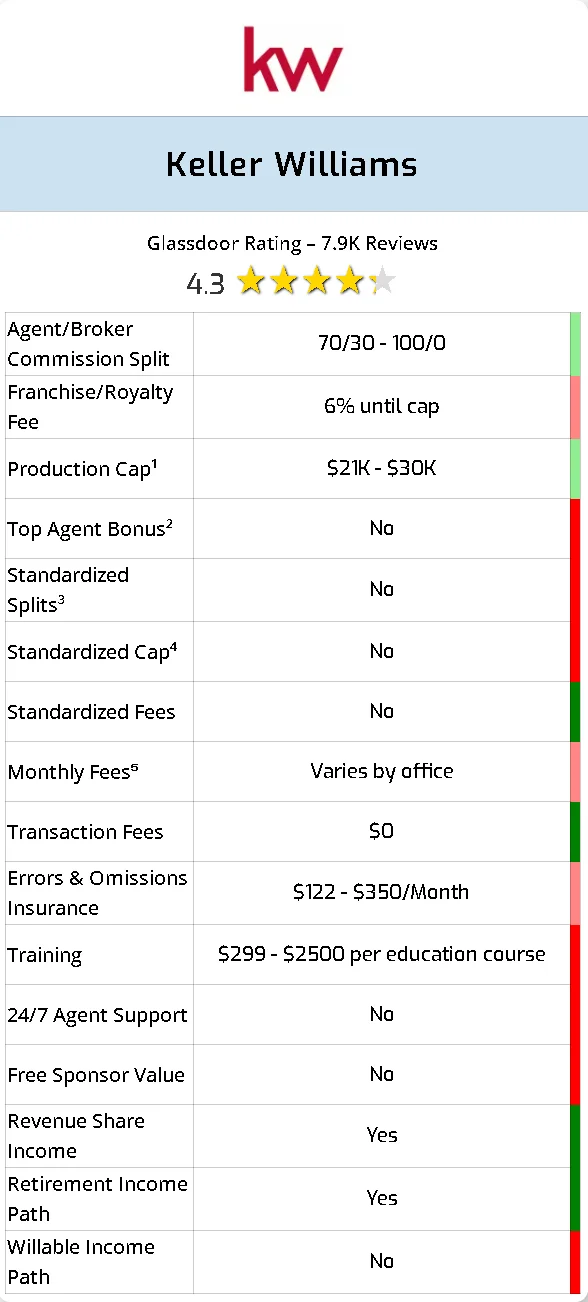

The commission splits and associated fees are crucial factors to consider when selecting a brokerage. Keller Williams offers flexible splits ranging from 70/30 to 100/0, with a 6% franchise/royalty fee until the cap is reached. In contrast, Coldwell Banker provides splits starting at 55/45 and going up to 90/10, with a franchise/royalty fee ranging from 5% to 6.5%.

Monthly fees also differ significantly. Keller Williams’ fees vary by office, adding a layer of complexity to the cost structure. Coldwell Banker’s fees are more predictable, ranging from $150 to $179 per month, and include the royalty fee. Additionally, while Keller Williams does not charge transaction fees, Coldwell Banker includes transaction fees within their royalty fees. These differences make each brokerage unique, potentially impacting an agent’s net income and financial planning.

Income Opportunities

The potential for additional income streams can significantly enhance an agent’s financial stability and growth. Keller Williams stands out by offering revenue share programs that provide a retirement and willable income path. These additional income streams can offer substantial long-term financial benefits and security. Conversely, Coldwell Banker does not offer such supplementary income opportunities, limiting agents primarily to their commission-based earnings.

Training and Support

Effective training and support are vital for both new and experienced agents. Keller Williams excels in this area, providing extensive training opportunities, though specific details on the extent of their offerings are not standardized across all offices. Agents at Keller Williams also benefit from various support structures, although 24/7 support is not available. In contrast, Coldwell Banker provides training that varies by office and lacks the extensive and consistent support system available at Keller Williams. This difference can be crucial for agents who require ongoing assistance and professional development.

Technology and Resources

In the modern real estate landscape, leveraging technology effectively is essential. Keller Williams is known for its robust technology platforms, offering tools that enhance productivity and client engagement. On the other hand, Coldwell Banker, while incorporating some technological tools, still focuses heavily on traditional, physical office spaces. This might appeal to agents who prefer a more conventional working environment but may not offer the same level of flexibility and innovation as Keller Williams.

Agent Satisfaction

Agent satisfaction is a key indicator of a brokerage’s effectiveness and overall agent happiness. Both Keller Williams and Coldwell Banker have high Glassdoor ratings of 4.3 stars, indicating strong agent approval and satisfaction. However, the volume of reviews differs significantly, with Keller Williams having 7.9K reviews compared to Coldwell Banker’s 2.6K reviews. The differences in agent satisfaction can often be attributed to the varying levels of support, training, and income opportunities provided by each brokerage.

Final Thoughts on Coldwell Banker vs Keller Williams

In comparing Coldwell Banker and Keller Williams, it’s evident that Keller Williams offers more favorable commission splits, extensive training, and additional income opportunities, making it a compelling choice for both new and experienced agents. The innovative technology and comprehensive support further enhance Keller Williams’ appeal. Coldwell Banker, while offering a traditional structure with some technological integration, has higher fees and fewer income paths, which may limit its appeal to agents seeking comprehensive support and modern business solutions.

For a more detailed comparison and to find the best brokerage for your needs, check out our brokerage comparison tool.

When making your decision, consider your specific needs and career objectives. Evaluate the advantages and disadvantages carefully to choose the brokerage that best fits your professional aspirations. Whether you prioritize comprehensive support and training or seek a brokerage with a more conventional setup, your decision should align with your long-term career goals and preferences.

Join our FREE Team at eXp Realty

Join the leading force in real estate with eXp Realty – the only profitable publicly traded brokerage over the past five years and holds the prestigious title of the best brokerage to work for. The benefits of eXp Realty are unmatched and will truly exceed your expectations!

When you join us at Smart Agent Alliance, you’ll also be part of the Wolf Pack at eXp Realty. Together we are one big team and we provide more FREE value than you’ll get anywhere else in the real estate business.

What’s included? Access our exclusive SAA Vault Assets to enhance your business efficiency, attend weekly team video calls filled with invaluable insights and top agent strategies, and receive the Social Agent Academy Program and Investor Army Courses – a combined value of over $1,500 – absolutely free. And that’s just the beginning! Explore more about our robust team benefits.

Don’t let this opportunity pass you by. Transform your real estate career, maximize your income, and secure your future. Contact us now to schedule a video consultation or email us at team@SmartAgentAlliance.com. We’re here to ensure your success.